Fed, ECB and BoE to Make Rate Decisions

It’s been another quiet start to trading in what is otherwise going to be a very busy week in financial markets, with a number of central banks scheduled to make interest rate announcements.

The Federal Reserve, ECB and Bank of England will be among those meeting this week, which should make Wednesday and Thursday particularly lively. Of these, only the Fed is expected to announce a change, with another 25 basis point rate hike all but priced in. That will take the number of hikes this year to three, as per its forecast towards the back end of last year, which markets were initially behind the curve on.

Source – CME Group FedWatch Tool

That currently remains the case for 2018, with the Fed projecting three more and markets only anticipating one or two. The most interesting thing on Wednesday is likely to be what the central bank says on this and whether the dot plot continues to forecast three hikes. With so many unknowns – vacant positions on FOMC and tax reform to name a couple – expectations are likely to change over the next six months, impacting how many rate hikes we actually get.

The BoE and ECB meetings are likely to be a more uninteresting affair, with both central banks having only recently tightened monetary policy and in no rush to do so again. That said, the ECB press conference can often be a volatile period for markets and traders will be keen to know what the next steps are beyond quantitative easing.

Oil’s Rally Falters After Kuwait Comments

Brexit Phase Two Talks Hang on Friday’s European Council Vote

Friday’s agreement between Theresa May and Jean-Claude Juncker on phase one of Brexit negotiations was an important milestone but this is likely to remain heavily in the news this week, with the European Council due to vote on it on Friday. While this is expected to be a formality, should anything get in the way of the vote being passed, it would be a major setback for the negotiations and prevent them moving onto phase two, in which the future trade relationship will be discussed.

OANDA fxTrade Advanced Charting Platform

Bitcoin Near Highs After CBOE Launches Futures Contract

Bitcoin won’t be far from the headlines this week, despite attention potentially being diverted elsewhere at times, with volatility in the cryptocurrency remaining at extraordinary levels over the weekend as CBOE prepared to launch its first futures contract. Still, Bitcoin is back trading near record highs this morning, allaying fears for now that the ability to short would trigger a sell-off.

The January contract on CBOE has eased off its highs a little after rallying immediately after the launch to trade more than 20% higher at one stage. While nervousness about short sellers may remain, early trading suggests the adverse impact that some feared may not materialize just yet.

Source – Thomson Reuters Eikon

Central Banks Competing For Stage Time With the Crypto Craze

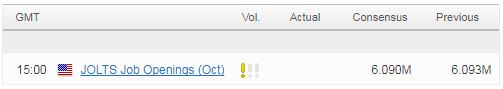

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.