Rome playing chicken with Brussels

Monday has got off to a relatively uneventful start, by recent standards, with the same underlying risks continuing to dominate as markets gradually pare some of the substantial losses of the last few weeks.

The minor developments that we have had in some of the more prominent stories of recent weeks haven’t had much impact on markets at the start of the week. Italy’s budget battle with Brussels is a prime example of that, with reports in recent days suggesting that the government has no plans to reduce its 2.4% deficit target for next year and is instead engaging in a game of chicken with the European Commission.

Coming on the back on one downgrade, with another potentially coming later this week when S&P is expected to release its review, it’s a risky approach from the populist coalition albeit one that is banking on the Commissions desire to avoid stoking further euroscepticism. It’s going to be a fine balancing act, with the next stage likely being the EC requesting that Italy resubmit a draft budget that abides by EU rules. Investors have taken the latest developments comfortably in their stride though with Italian yields actually falling on the day and bank stocks benefiting from the more relaxed mood.

European open – Markets not feeling China benefit

Falih downplays oil weapon

Oil markets have also settled a lot in recent days, having been caught up in the stock market sell-off a couple of weeks ago. Fears about a Saudi oil response to possible US sanctions in the aftermath of the alleged murder of journalist Jamal Khashoggi were short-lived and Energy Minister Khalid al-Falih sought to reassure markets on Monday, claiming the country has used it as a responsible economic tool for decades and isolated it from politics. He also stated that there is no intention to repeat a 1973-style oil embargo.

This will certainly reassure people given that prices are already very elevated and the prospect of $100 a barrel oil is no longer particularly outrageous. There does appear to have been a moderating of bullish fever for now but prices are still very well supported and remain at high levels. With Trump also coming across very keen to avoid a tit-for-tat with such an important ally of the US, having so wilfully embraced the Saudi’s assessment of what happened on the day Khashoggi disappeared, I don’t expect this to escalate any further between the two which could be good for oil consumers. It could be even better if the country, as a gesture of goodwill, increases efforts to fill the oil void left by Iranian sanctions.

A nervous beginning to the start of the week

Week ahead could be very volatile

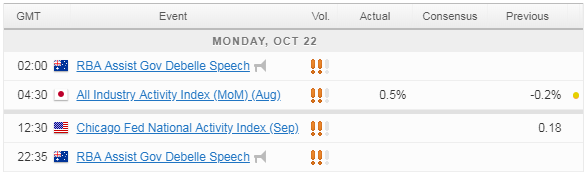

While the week ahead could be very interesting from both a political and economic viewpoint, Monday is looking rather quiet. No economic data of note and earnings season picking up as the week progresses doesn’t make for a particularly exciting start. That said, with politics being such a big driver of market sentiment this year, market participants will likely remain very vigilant.

As the week progresses things get much more interesting, with the Bank of Canada and ECB announcing rate decisions on Wednesday and Thursday, respectively, US GDP being released on Friday and 160 S&P 500 companies reporting on the third quarter. Monday may well just be the calm before the storm.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.