US Crude climbed higher today following inventory data from American Petroleum suggest that implied demand for crude has risen once again, with the API report reporting a decline of 5.7 million barrels last week versus analysts consensus estimate of a 2.8 million decline. Currently, prices have since climbed from to a high of 98.7, rebuffing bearish pressure which came from weaker than expected Chinese Manufacturing PMI numbers which managed to push Asian stock prices lower. This suggest that this bullish momentum is strong, and we should be seeing some more bullish extension during European and US trading sessions today if all things remain the same (e.g. no surprise bearish announcements that may affect risk appetite).

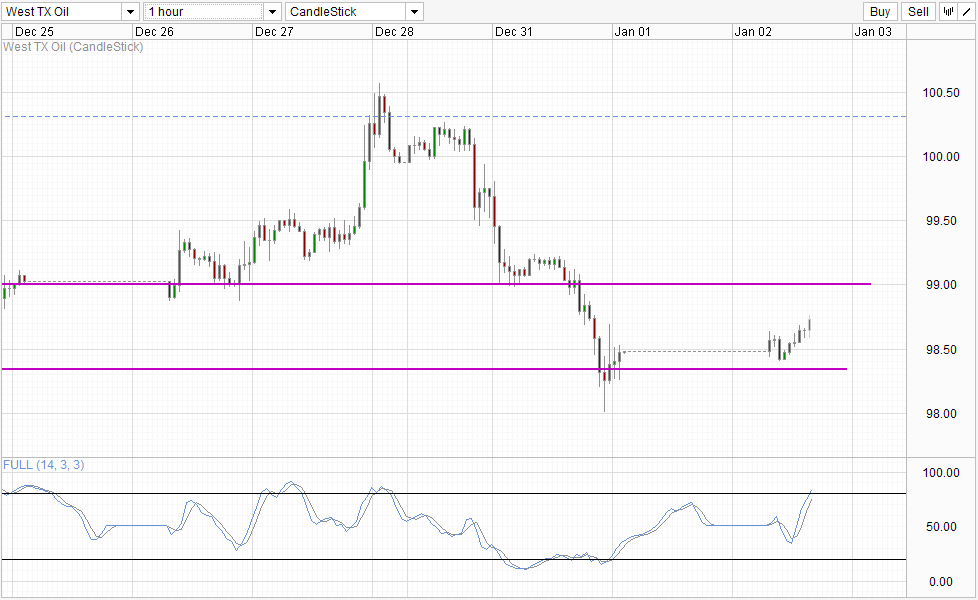

Hourly Chart

However, it should be noted that for all its worth, current bullish endeavour pales in comparison to the huge decline seen at the start of this week. We are still a far distance away from round figure resistance of 99.0, and yet momentum indicated by Stochastic suggest that we are already Overbought. Without breaking 99.0, it is hard to imagine current push as anything beyond a short-term correction, and that assertion would be correct given that prices have actually started pulling back before the API numbers were released, and the bullish reaction during the initial pullback was much stronger compared to the post API reaction, lending credence to the assertion that current move may simply be correction rather than a fresh bullish push.

If the above mentioned is correct, then the likelihood of 99.0 holding becomes higher, which would also imply that the decline that started early this week remains in play, and there is a risk that prices may even revert lower from here without testing 99.0.

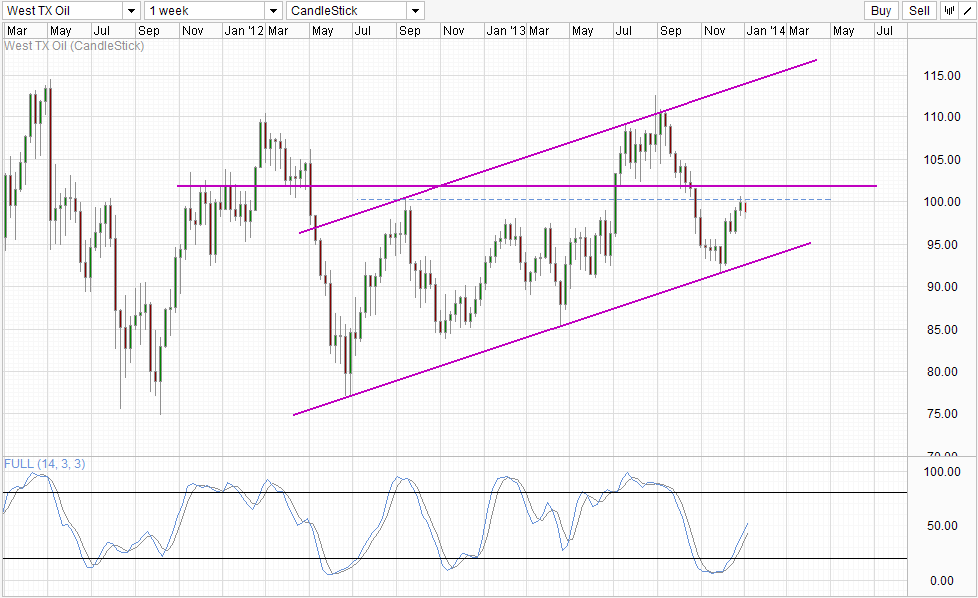

Weekly Chart

Long-term chart is mixed. On one hand, one can construct a bullish outlook based on Channel Bottom rebound in conjunction with Stochastic readings in the midst of a bullish cycle. If this interpretation is correct, a move towards Channel Top or at the very least close to 110.0 based on current Stoch levels is possible. However things are not so clear cut, with 100 – 102 resistance band in the way. This wouldn’t necessarily mean that price will not be able to push up much higher in the long run, but right now it is hard to formulate a long-term bullish narrative.China and India, 2 of the largest manufacturing economies remain weak. Global consumption of crude is expected to fall, and this has already forced OPEC to slow down production back in late 2013. Furthermore, production from US has been increasing steadily for both economic and political reasons. As such, it is hard to imagine Crude being able to climb much further from here.

Taking a step back, it is clear that why WTI prices have rallied in the month of December has to do largely with the decline in Crude inventory, breaking the 10 week consecutive chain of inventory build up. This decline cannot be said as surprising, as December has a seasonal tendency for inventory to go lower (lower production and higher consumption). The only real surprise was the magnitude which inventory has declined, but that could simply be interpreted as a temporary pullback following the stupendous 10 week run earlier. Hence, traders who believe that the oversupply/under-demand situation has reversed may wish to hold on a few weeks to confirm this belief. From a technical point of view, it is likely that price should have either broken the 100 – 102 resistance band or revert lower from here in a few weeks, hence we would also have technical confirmation of price direction – perfect recipe for strong directional push to follow.

More Links:

GBP/USD Technicals – Biggest Gainer In H2 2013 Leading 2014 Charge

AUD/USD Technicals – Early Bears Overextending On China PMI

EUR/USD Technicals – Bears Claiming First Blood In 2014

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.