Prices traded higher despite strong bearishness seen early yesterday. However this move isn’t unexpected, with Channel Top (see chart below) being the natural bullish target following the rebound off 0.882 – 0.885 support zone.

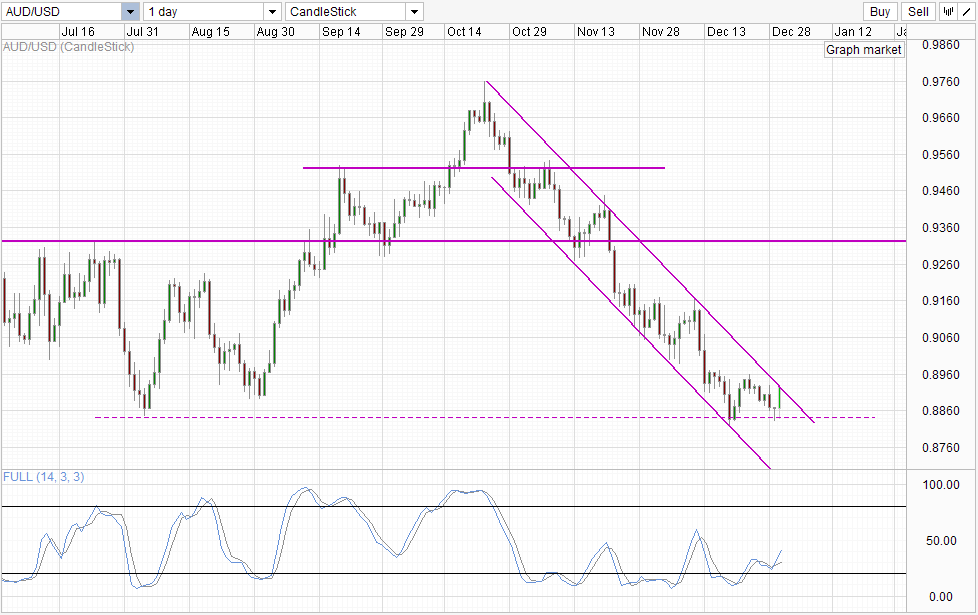

Daily Chart

The question that needs to be asked is whether bulls will be able to launch a bullish breakout from here. The possibility is there with Stochastic readings showing divergence between Stoch/Signal line while pointing higher – suggesting that bullish momentum is building up. With Stoch value being so low right now, a bullish breakout from here may be able to bring us all the way into the 0.905 – 0.916 consolidation zone without being Overbought.

However overall technicals still favour a bearish push. Lets start with Stochastic, which is actually showing a divergence with Stoch curve higher than a week ago yet price clearly showing the opposite. This divergence weakens the bullish cycle signal and traders will need to seek further confirmation of strong bullish conviction. Also, 0.896 will act as yet another resistance even if prices manage to break up higher. Hence it will definitely not be a walk in the park for bulls to go hit 0.905, with likelihood of bearish reversals high considering the strong bearish fundamental factors surrounding AUD and bullish USD fundamentals that has been the theme of 2013 which will continue into Q1 2014 at the bare minimum. Therefore, for AUD/USD to push up for an extended period of time will require something truly extra-ordinary, and that unfortunately is hard to fathom right now. All these favor a bearish rejection by Channel Top which will bring us back towards Channel Bottom with 0.882 – 0.885 providing interim support.

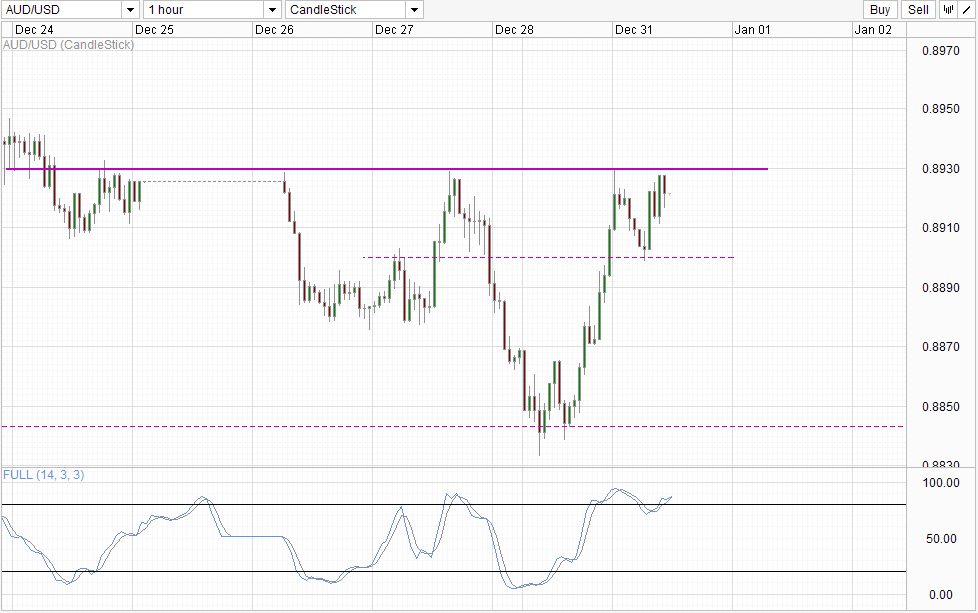

Hourly Chart

Hourly Chart agrees with the continued bearish bias of Daily Chart as prices are still staying below the 0.893 resistance. Stochastic readings are Oversold, and even though both Stoch/Signal lines are pointing higher, both lines have converged and appears to be topping soon. Hence, the likelihood of 0.893 resistance holding is high, and a rebound towards 0.90 round figure support and even towards 0.888 is possible.

A look across other major currency pairs such as EUR/USD and GBP/USD suggests to us that yesterday’s rally in AUD/USD may be USD inspired. This is an important observation because USD is actually slated to strengthen further in 2014 as mentioned above and in our previous analysis. Assuming that the forecast about USD in 2014 is correct, it will be hard to see current USD weakness as something beyond a short-term correction/profit taking, and we could be seeing AUD/USD reverting back lower once again when the correction ends.

More Links:

GBP/USD – Pound Rally Continues As US Housing Data Disappoints

USD/CAD – Loonie Remains Under Pressure

USD/JPY – Above 105 As Yen Remains Under Pressure

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.