Mirror mirror on the wall, who’s the most bullish of them all?

Within USD majors, the most bullish one appears to be GBP/USD. It seems that Cable bulls have brought 2013 bullishness with them into 2014, with prices climbing higher on market open despite USD strengthening against most other majors (see AUD/USD and EUR/USD). The reason for this strong bullishness was led by expectations that the Bank of England will be more hawkish in 2014 after seeing US Fed starting tapering in Dec last year. Furthermore, incumbent Governor Carney who is newly in charge for less than half a year was never known to be dovish to begin with, and has been relatively hawkish with his policies when leading Bank of Canada. As such, it will not be surprising to see Carney starting to tighten UK’s monetary policy.

There is an issue though, Bank of England have not actually said nor even hint that they’ll tighten in the near future. Also, there hasn’t been any recent Bank of England speeches/announcements in the past few weeks, which means that bulls are literally running on reserves right now – not a good prospect for long-term continued rallies especially given that USD is currently and will continue to drag Cable down.

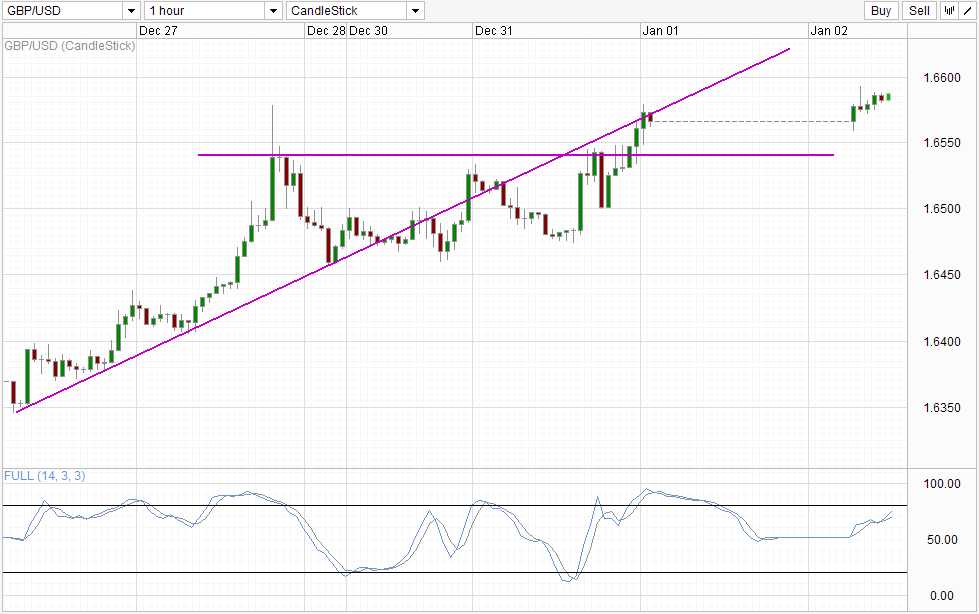

Hourly Chart

That being said, current bullish impetus is undeniable, and prices are on the verge of yet another bullish push with current prices trading higher than the recent highs of 1.658. Stochastic readings have also reverted higher, suggesting that the recent bullish rally since Christmas (which in itself is a bullish extension of the push from 13th Nov) is back in play, favoring a bullish extension play from here. However, with Stochastic readings close to Overbought, and the rising trendline acting as a ceiling, there is a possibility that we could see a bearish pullback/correction fairly soon, agreeing with the fundamental analysis mentioned above.

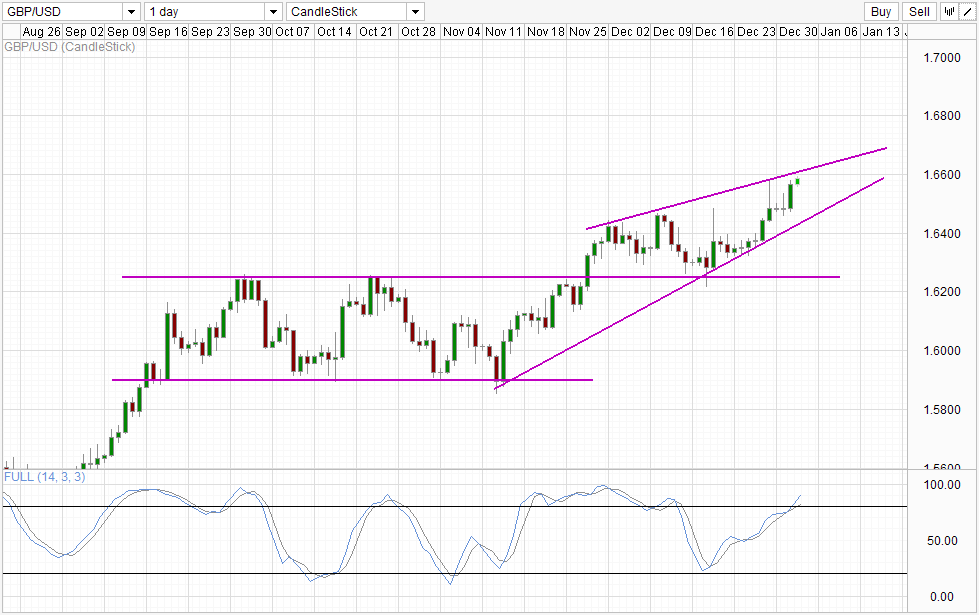

Daily Chart

Daily Chart concurs, with price action looking bullish yet Overbought stochastic readings with wedge ceiling not too far away suggesting that bullish endeavours from here out may be limited. Nonetheless, bulls can take heart that prices continued bullishly today, confirming that the bullish pushes during recent holiday season is not a fluke, and once again anchoring GBP/USD bullish conviction in the long-run.

From a technical perspective, should Wedge Ceiling holds, we could see a bearish push back towards lower wedge which is also confluence with the previous Dec ceiling of 1.646 – 1.648. This increases the chances of a bullish rebound which will keep overall bullish bias intact.

More Links:

USD/CAD – 2013 In Review

AUD/USD – 2013 In Review

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.