USD/INR traded higher today following the gain in strength of USD overnight brought about by the latest “hawkish” FOMC monetary policy statement. However, most major pairs have actually retraced their losses against the Greenback since, with USD gaining a mere 0.06% against an evenly weighted basket of major currencies on a D/D basis. On the other hand, USD/INR actually continue trading higher, even surpassing yesterday’s post FOMC highs a couple of hours ago.

This would usually mean that Rupee is inherently weak, and we can expect more USD/INR gains from here especially if USD strengthens further. But in this case, it should be noted that USD/INR was actually trading flat when USD was clearly strengthening from 23rd Oct to 30th Oct, suggesting that the strong bullish response seen right now may simply be due to technical influences just like before.

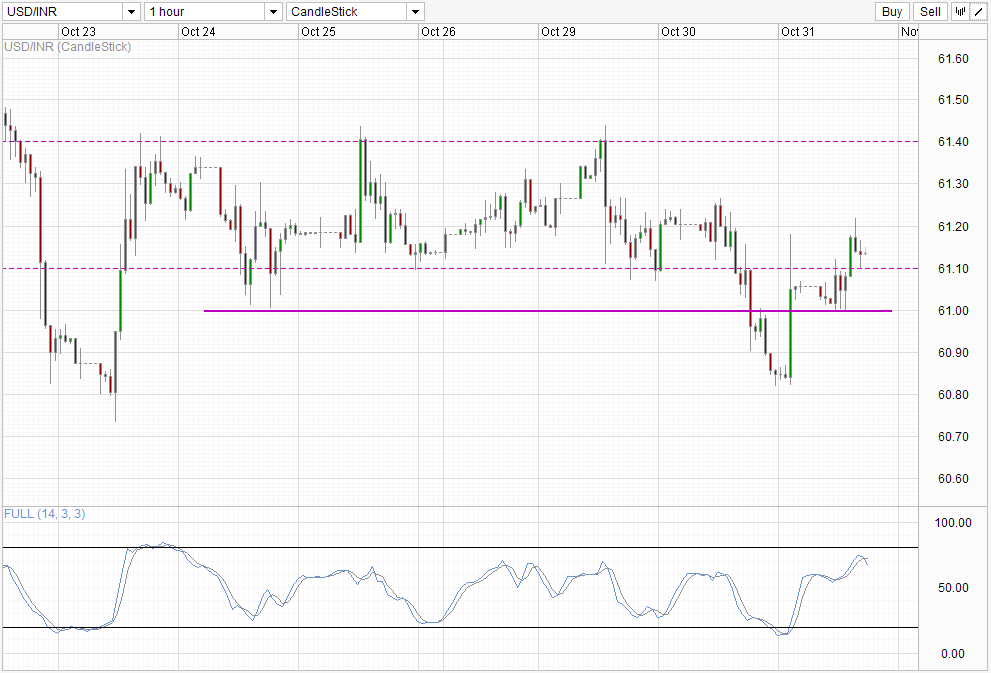

Hourly Chart

If the assertion is true, then 61.4 would become a possible bullish target, but price is currently facing some slight resistance due to hot money inflows into stocks coupled with month end exporters sales keeping Rupee strength intact for now. Once the flow stop (e.g. tomorrow), USD/INR should move back towards 61.4 once again. Failure to do so would suggest that the previously made assertion that price is trading sideways may be invalid and we need to consider the possibility of price moving lower once again. Stochastic agrees with such a possibility, with readings currently the highest in a week and appears to be forming a top right now.

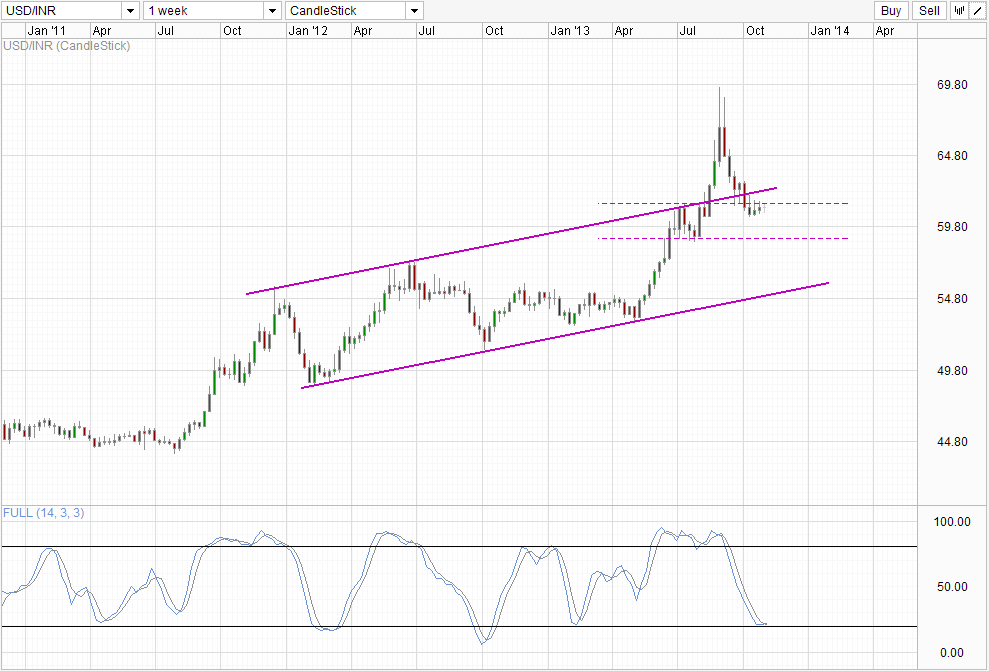

Weekly Chart

Nothing much has changed for the weekly chart analysis. As long as prices stay under 61.4, immediate pressure will be on the downside towards 59.0 and potentially forming a Head and Shoulders pattern which will open up a further bearish movement towards Channel Bottom. However, overall long term trend remains bullish, and Stochastic readings concur, hence traders need to be extremely careful longing Rupee here as it will be considered a counter-trend trade. Furthermore, fundamentals continue to favor stronger USD as weakness in Indian economy remain. As such, strong bearish confirmation should be sought on both long and short term charts before we automatically assume that price will simply move towards 59.0 from here.

More Links:

WTI Crude Technicals – Remaining Bearish But Sideways Trend Possible

US10Y – Stubbornly Above 128.0

Gold Technicals – Lower Post FOMC But Stronger Bearish Signals Needed

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.