Rupee remains steady against Greenback despite yesterday’s sudden weakness in USD during early US session which drove AUD/USD, EUR/USD and GBP/USD higher. Even stranger is that USD/INR actually rallied higher during the time, suggesting that that Rupee actually weakened even more than Greenback, highlighting the bearishness of India’s currency which has weakened more than 1% against USD since the turn of the year.

The culprit for the weakness seen in INR comes from the weakening Sensex, which has seen 4 consecutive days of decline and is likely to chalk one more today. With stock prices declining there is very little reason for investors to keep their funds in India since inflation rates have far outgrown deposit rates, resulting in the devaluation of Rupee.

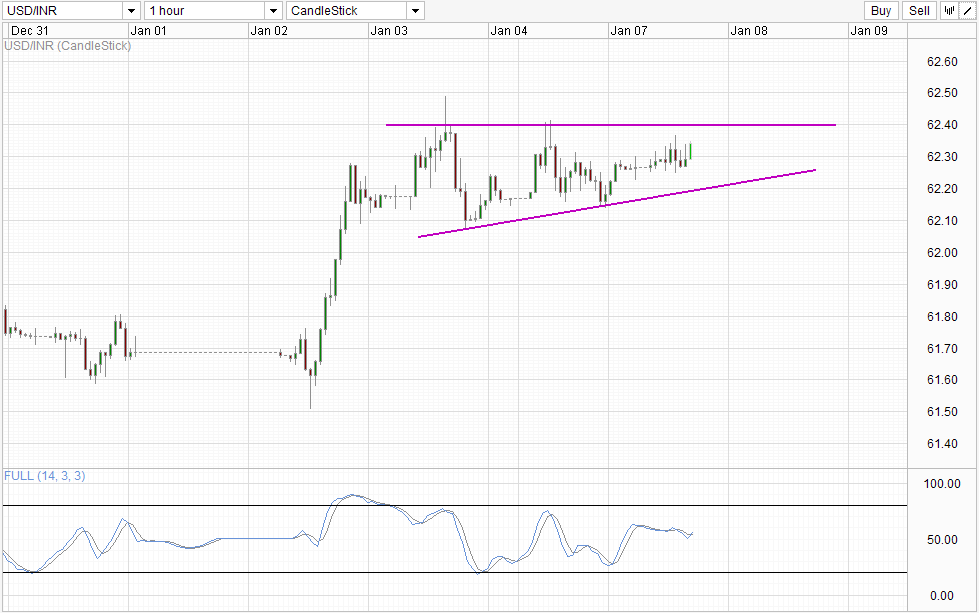

Hourly Chart

Currently USD/INR is mostly flat, trading within a band between 62.1 – 62.5. However, without the weaken USD, one wonders if USD/INR would be able to climb much higher and may have even pushed beyond 62.5 already. Stochastic readings have been flat but a new trough has just been formed with Stoch curve crossing the Signal line from below, suggesting that the bullish cycle that started during early US trading session yesterday may be resuming, allowing price to hit towards soft resistance of 62.4 in the near term.

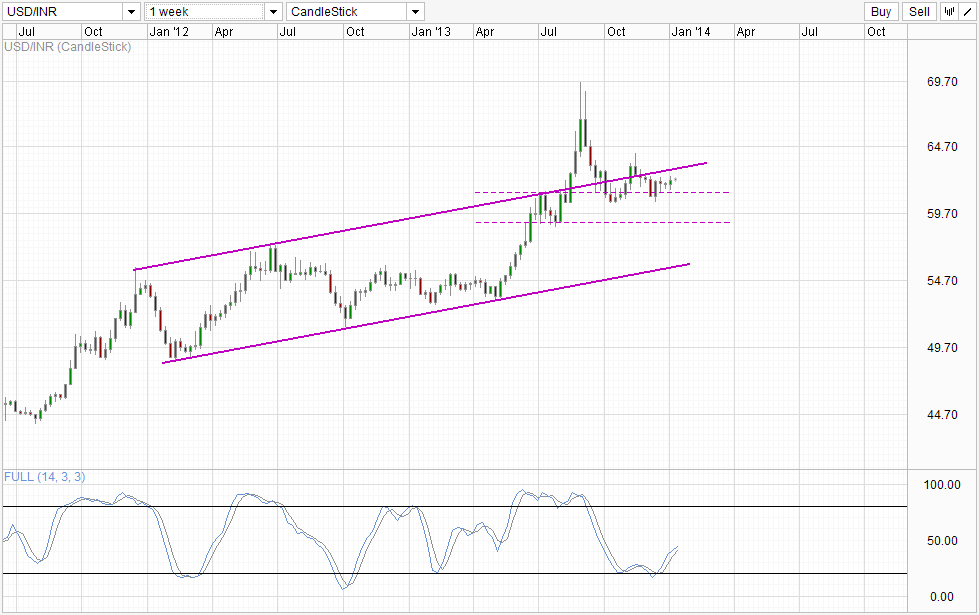

Weekly Chart

Long-Term direction agrees with a bullish push in line with what fundamentals with a weak India economy vs strong US economy narrative. Also, even if we were to consider that prices have breached into the rising Channel and hence should open up mid-term bearish target of Channel Bottom, it should be noted that prices are in the midst of a rebound off 61.3 support and a retest of Channel Top is equal if not more likely. This is in line with what Stochastic tell us, where stoch curve is pointing higher, suggesting that we are currently in a bullish cycle whose starting point coincide with the rebound off 61.3.

More Links:

EUR/USD Technicals – Bears Maintain Pressure Despite Bullish Pullback Yesterday

AUD/USD Technicals – Bears Ignoring Improved Trade Balance, Higher Stock Prices

Gold Technicals – Mild Bearish Sentiment Seen After Sudden Plunge

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.